colorado estate tax exemption

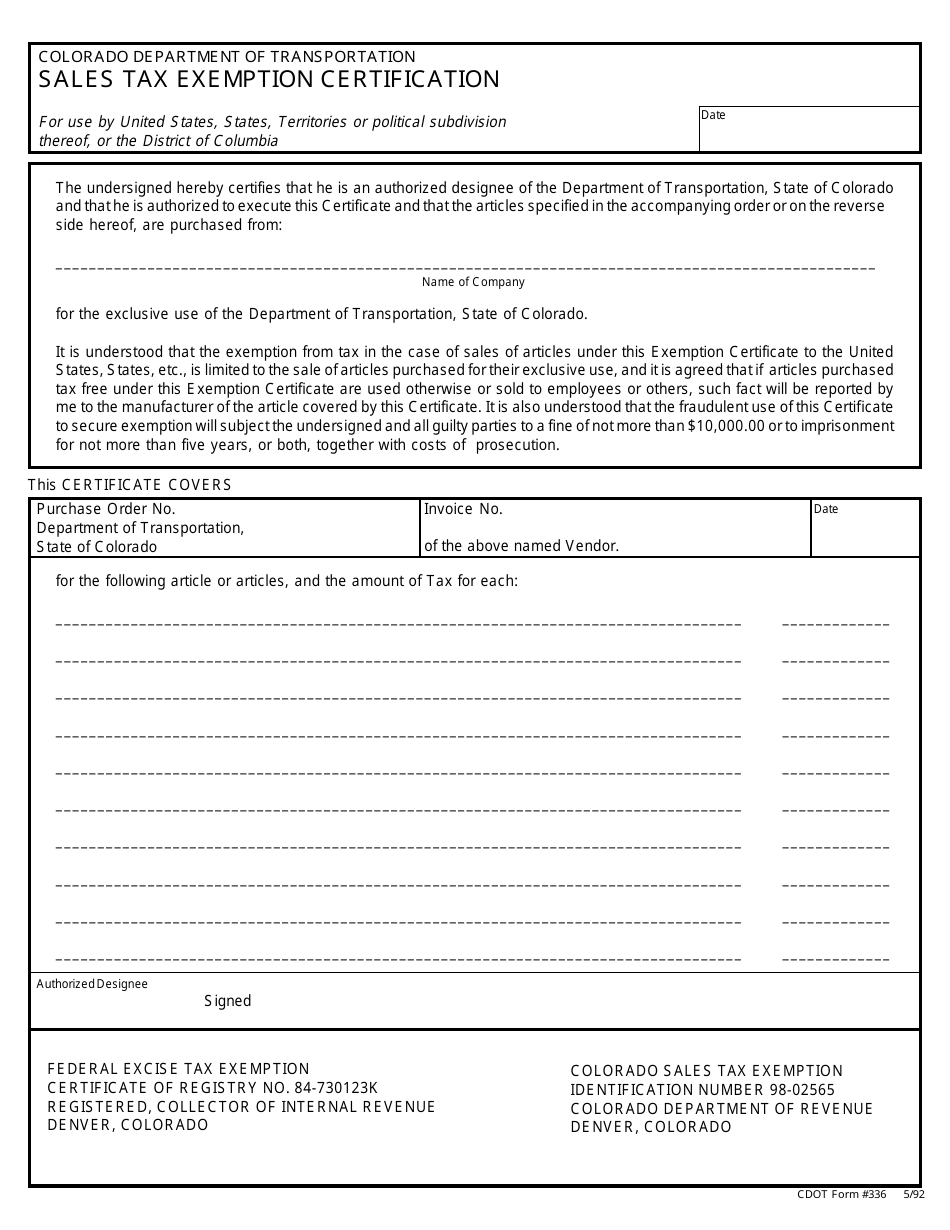

Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

There are two main types of bankruptcy for individuals.

. If the return is filed on paper the total from the Deductions schedule must be reported on the sales tax return and the Deductions schedule must also be submitted with the sales tax return. Note however that the estate tax is only applied when assets exceed a given threshold. Forms are mailed by March 1.

Specifies that a senior is deemed to be a 10-year owner-occupier of a. Even though there is no estate tax in Colorado you may still owe the federal estate tax. They will average around half of 1 of assessed value.

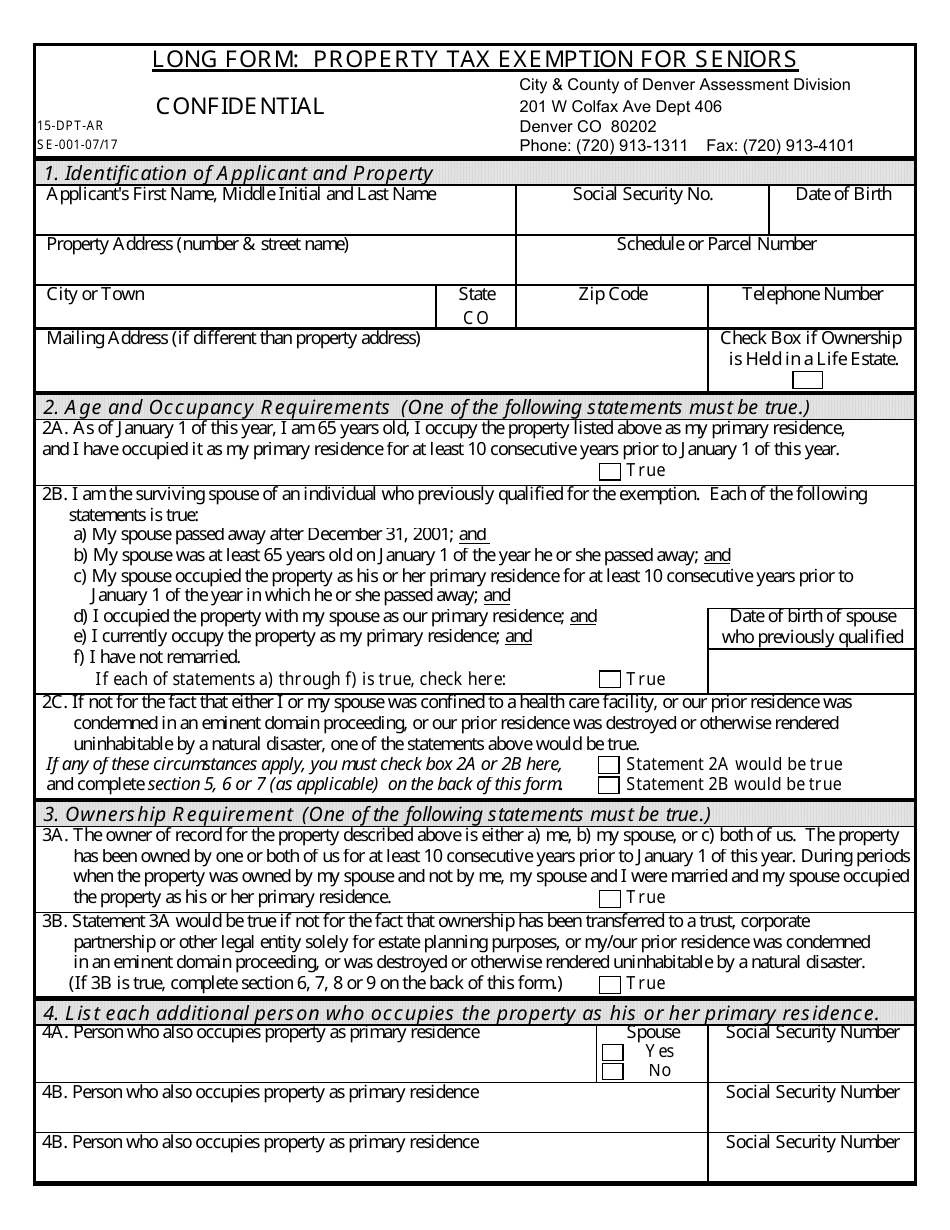

Up to 25 cash back The homestead exemption is 105000 if the homeowner his or her spouse or dependent is disabled or 60 years of age or older. You can also own a life estate in the property If Your Spouse iswas the Owner of Record. You do not have to be the sole owner of the property.

The property need only be declared exempt once and that declaration. Federal Estate Tax Exemptions For 2022. Are the current property owner of record.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Federal legislative changes reduced the state death. If you have not received an annual report and instructions by postal mail by March 15 2022 please contact Exemptions at 303-864-7780 and provide your file number see previous years form and updated mailing address.

Property taxes in Colorado are definitely on the low end. A state inheritance tax was enacted in Colorado in 1927. If the exemption is made available in the future seniors must reapply for it.

The tax year for which you are seeking the exemption. Have been the primary occupant for at least ten consecutive years prior to January 1. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit.

A state inheritance tax was enacted in Colorado in 1927. Individuals can exempt up to 117 million. If you own a house worth 120000 and you have a mortgage balance of 80000 you have 40000 of equity in the property.

Federal legislative changes reduced the state death. Property taxes assessed during any tax year prior tothe year in which the veteran first files an exemption application. The Taxpayer Relief Act of 1997 exempts most homeowners from paying capital gains tax on the profits from selling their homes.

Colorado seniors are eligible for a property tax exemption if they are. For tax years 2022 and later the Colorado income tax rate is set at 455. Taxpayer Relief Act of 1997.

In 2002 the state granted 123380 exemptions and paid counties about 62 million in lost tax revenue. Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. These values may also be impacted by gifts that you make during your lifetime.

Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado its departments and institutions and its political subdivisions county and local governments school districts and special districts in their governmental capacities only 39-26-7041 CRS. The average tax savings totaled 503. It is one of 38 states with no estate tax.

A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000 in the actual value of their primary residence is exempted from property taxation The state pays the exempted portion of the property tax The. State wide sales tax in Colorado is limited to 29. No more than one exemption per tax year shall be allowed for a residential property even if one or more of the - owner occupiers qualify for the senior exemption and theboth disabled veteran exemption.

This tax is portable for married couples. A qualifying senior must be 65 years of age or older at the end of the income tax year for which the credit is claimed and have income. Married couples can exempt up to 234 million.

There is no estate tax in Colorado. A retailer may also accept from an out-of-state purchaser a fully completed Standard Colorado Affidavit of Exempt Sale DR 5002 Sales Tax Exemption Certificate DR 0563 or Multistate Tax Commission Uniform Sales Use Tax ExemptionResale Certificate. Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as.

In other words when an estate is passed on the federal government taxes the transfer. The deadline to file a 2022 Exempt Property Report is April 15 2022. Real Property Transfer Declaration TD-1000 Real Property Transfer Declaration Completion Guide TD-1000 Government Assisted Housing Questionnaire.

At least 65 years old on January 1 of the year in which he or she qualifies. Chapter 13 bankruptcy although similar. You can own it with your spouse or with someone else.

The Colorado Homestead Exemption allows one to exempt up to 75000 of their real property value when filing bankruptcy. The estate tax is a tax applied on the transfer of a deceased persons assets. The annual gift exclusion is 15000.

Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. Section 6 creates an income tax credit that is available for 10 tax years beginning on January 1 2020 for a qualifying senior. Lets find out.

Property Taxation - Declaration Schedules. For property tax years commencing on or after January 1 2022 the bill. The following are the federal estate tax exemptions for 2022.

The retailer must retain a copy of the completed exemption form. Hotel or Motel Mixed Use Questionnaire. According to the Act if you sell your primary residence you are exempt from capital gains taxes on the first 250000 of profit 500000 if married filing jointly.

Chapter 7 bankruptcy is typically applied to lower income individuals and involves liquidating your assets to pay off your debt. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. For the purpose of the exemption you are also considered an.

Colorado Estate Tax. However under certain circumstances involving fiscal year state revenues in excess of limitations established in the state constitution the income tax rate for future tax years may be temporarily reduced to 45. For the 2020 tax year Coloradans claimed nearly 270000 exemptions totaling nearly 158 million in county taxes that had to be backfilled by the state.

If you file a Chapter 7 bankruptcy you can use the Colorado homestead exemption to. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit. For 2021 this amount is 117 million or 234 million for married couples.

Increases the maximum amount of actual value of the owner-occupied residence of a qualifying senior or veteran with a disability that is exempt from property taxation from 200000 to 400000. Only organizations exempt under 501 c. When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return.

The following documents must be submitted with your application or it will be returned. On average a qualifying applicant saved 585. There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city.

Tax Exemption For Period Products Diapers Passes Colorado Legislature Subscriber Only Content Gazette Com

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2020 Estate Planning Update Helsell Fetterman

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Recent Changes To Estate Tax Law What S New For 2019

2020 Estate Planning Update Helsell Fetterman

Colorado Inheritance Laws What You Should Know Smartasset

A New Era In Death And Estate Taxes

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

Form 15 Dpt Ar Download Printable Pdf Or Fill Online Long Form Property Tax Exemption For Seniors Colorado Templateroller

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax Everything You Need To Know Smartasset

A New Era In Death And Estate Taxes

What You Need To Know About The Final Estate Tax Portability Rules